Bookkeeping and Your Business

Running a business can feel like a whirlwind. You’re juggling clients, managing your team, and staying ahead of competitors—all while trying to make sense of your finances. It’s no surprise that bookkeeping often gets pushed aside, but here’s the hard truth: Without financial clarity, you’re flying blind. As a financial and bookkeeping expert, I’ve helped all types and sizes of businesses control their numbers, unlock growth and achieve their goals. At J Miller Bookkeeping we believe these are the 10 tenants for achieving financial clarity.

- Embrace the “Financial GPS” Mindset

Think of your finances as a GPS for your business. You wouldn’t take a road trip without a map, so why run your business without a clear financial direction?

Practical Steps:

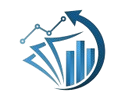

- Set clear financial goals. Break them down: quarterly revenue, profit margins, and cash reserves.

- Review your financial statements regularly. Aim for monthly—not just at tax time.

- Track Key Performance Indicators that matter. Your books aren’t just history; they’re the roadmap for where you’re heading.

- Know the “Invisible Costs” Killing Your Profits

Most business owners focus on revenue, but what about the silent profit killers?

- Recurring subscriptions you forgot about

- Overpriced vendors or services

- Inefficient workflows that cost time (and time is money)

💡 Pro Tip: Audit your expenses line by line every quarter. Ask, “Is this helping my business grow, or is it just draining resources?”

- Separate Business and Personal Finances

You’d be surprised how many small business owners still mix personal and business expenses.

Why it matters:

- It complicates tax filings and leads to distracting tax audits.

- It’s a red flag for auditors and can lead to significant penalties.

- It skews your understanding of profitability and viability of decision and plans.

💡 Pro Tip: Open dedicated business banking accounts. Make owner distributions transparent while minimizing tax exposure.

- Leverage Technology—But Wisely

Tech can make bookkeeping faster and easier, but only if you choose the right tools for your needs. Some good choices:

- QuickBooks The gold standard for small businesses.

- Xero: Simplified multicurrency tracking.

- Gusto: Effective and accurate payroll and 1099 payments

- POS, Inventory Management

Remember, tools are only as good as the processes behind them.

💡 Pro Tip: Take time to set tools up correctly or hire a pro such as J Miller Bookkeeping to tailor your Technology Stack.

- Understand Tax Strategy, Not Just Tax Compliance

Paying taxes is unavoidable, but overpaying is not.

Key Areas to Focus On:

- Deductions: Are you maximizing home office expenses, travel, and professional services?

- Entity Structure: Could switching to an S-Corp save you thousands?

- Retirement Plans: Contributions to SEP IRAs or Solo 401(k)s reduce taxable income while securing your future.

💡 Pro Tip: Take a proactive approach to tax planning. It can save you significant money—but don’t wait until year-end. Engage a professional bookkeeper and tax professional to help you navigate clear of financial shoals.

- Build a Cash Reserve—Your Safety Net

Did you know that 82% of businesses fail because of cash flow issues? A cash reserve isn’t a luxury; it’s a necessity.

- Learn to examine in detail your current and future cash flows.

- Plan and budget your cash flow to anticipate major capital acquisitions.

- Evaluate revenue sources for cash flow contributions.

- Monitor expenses for unexpected or changing cash demands

How Much? Aim for at least three to six months of operating expenses. This gives you breathing room to navigate unexpected challenges.

How?

- Set aside a percentage of revenue each month.

- Treat your reserve like a “non-negotiable expense.”

- Partner with a Financial Expert (When You’re Ready)

Even the most successful entrepreneurs need help. Whether it’s a bookkeeper, CPA, or financial advisor, having the right partner can:

- Free up your time.

- Provide clarity on complex financial issues.

- Help you make data-driven decisions.

💡 Pro Tip: Don’t let yourself be overwhelmed with the administration of financial activities. Leverage experts to augment your team so you can focus on business operations and strategy.

My Role as Your Bookkeeper: I don’t just crunch numbers; I help my clients see the bigger picture, avoid costly mistakes, and focus on growth.

- Know Your Numbers (Really Know Them!)

Most business owners glance at their P&L (Profit and Loss) and think they’re covered. But true financial clarity comes when you:

Understand your cash flow trends: Where is your money coming from, and where is it going?

Identify your profit centers: Which products or services bring the most revenue, and which are eating your resources?

Track key metrics: Metrics like gross profit margin, customer acquisition costs, and break-even points can tell you more about your business than raw sales numbers ever will.

💡 Pro Tip: Schedule a “Finance Friday” every week to review your numbers and spot trends before they become issues.

- Embrace Budgeting as a Growth Tool

Budgets aren’t just about cutting costs; they’re about strategically allocating resources.

- Create a zero-based budget: Assign every dollar a purpose.

- Invest in what works: Double down on strategies and tools that drive results.

- Monitor and adjust: Your budget isn’t static—review it monthly to ensure it reflects your current goals.

💡 Pro Tip: Treat unexpected profits like windfalls—invest them back into your business instead of spending them immediately.

- Last but not least: Plan for Taxes Year-Round

Taxes shouldn’t be a surprise. Avoid the last-minute panic by:

- Setting aside a percentage of your income for taxes.

- Keeping track of deductible expenses (home office, travel, professional services) – yes, I repeat it because it is essential.

- Consult a tax professional quarterly to ensure you’re on track.

💡 Pro Tip: Don’t wait until tax time to retain a tax professional. Promote a dynamic dialogue with your tax professional and your bookkeeper to avoid surprises.

Let’s Keep the Conversation Going

Finances don’t have to be overwhelming. With the right mindset, tools, and support, you can achieve financial clarity and take your business to the next level.

Contact J Miller Bookkeeping and we can help you get on the path to ensure business success.

J Miller Bookkeeping